In recent times, despite facing numerous challenges, the logistics industry has shown both positive signs and divergent developments among its participants.

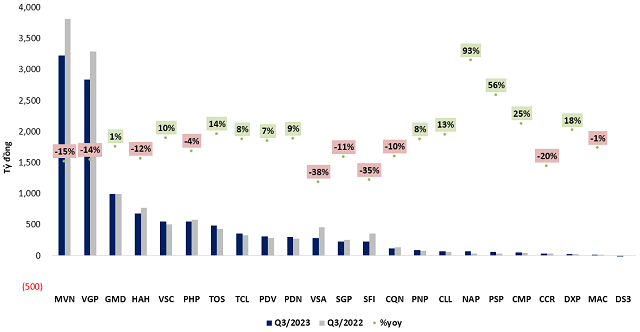

According to statistics from VietstockFinance, among the 24 logistics companies that have reported their financial statements for the third quarter of 2023 on the HOSE, HNX, and UPCoM stock exchanges, 12 companies reported an increase in profits, 8 reported a decrease in profits, 1 transitioned from losses to profits, and 3 continued to report losses.

The third quarter of 2023 proved to be a challenging period for logistics companies, with the total gross revenue of the reporting companies exceeding 11.6 trillion VND, a 10% decrease compared to the same period last year. Many companies in the industry experienced negative growth, such as MVN (Vinalines), HAH (Hai An Transport and Stevedoring Joint Stock Company), and notably VSA (Vietnam Maritime Agent Joint Stock Company), which saw a significant 38% drop in gross revenue.

For MVN, its total revenue for the third quarter reached 3.232 trillion VND, a 15% decrease primarily attributed to a 35% drop in transport services, which fell to 1.034 trillion VND. Another significant revenue stream for MVN, port operation and maritime services, also decreased by 7% to reach 1,682.3 trillion VND. Although other segments of MVN’s services experienced a growth rate of up to 24%, they contributed relatively less to the overall revenue compared to the two previously mentioned segments.

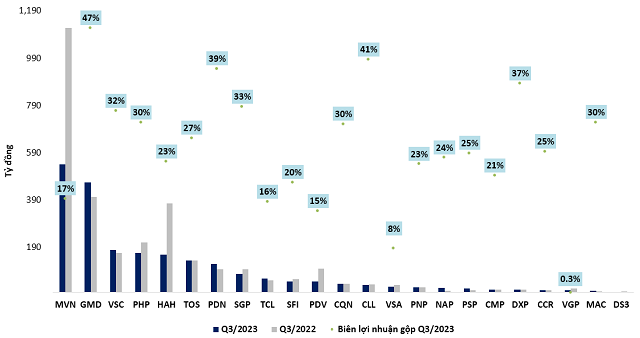

The gross profit margin for MVN’s transportation business decreased by 28 percentage points to 7%. The overall gross profit margin for MVN decreased by 12.5 percentage points to 16.7%, resulting in a gross profit of 540.7 billion VND, a 52% decrease.

HAH reported a net revenue of 681 billion VND for the third quarter of 2023, a 12% decrease, mainly due to an 11% decrease in revenue from ship operation, which accounted for 80% of the company’s total revenue. HAH’s gross profit decreased to 158 billion VND due to increased costs and higher capital expenses. The gross profit margin decreased from 48% to 23%.

There were two standout performers in terms of revenue growth: GMD (Gemadept) and VSC (Container Vietnam Joint Stock Company). Specifically, GMD saw a 1% increase in revenue, reaching 998 billion VND, with port operation contributing significantly to its revenue at 778.7 billion VND. VSC experienced a 10% increase in revenue, reaching 557.2 billion VND, primarily driven by container loading and unloading services. VSC currently operates two main ports, Green and VIP Green, at full capacity with stable service prices. After deducting the cost of goods sold, VSC achieved a gross profit of 178.7 billion VND, an 8% increase, with a slight decrease in the gross profit margin from 32.5% to 32%.

NAP (Nghệ Tĩnh Port Joint Stock Company) was a surprising standout with the highest revenue growth in the logistics industry and one of the highest revenue growth rates in the entire stock market. NAP’s gross revenue reached 72 billion VND, a remarkable 93% increase, and the gross profit margin increased from 16.9% to 24% in the third quarter of 2023.

One company that transitioned from losses to nearly 2 billion VND in gross losses was DS3 (Road No. 3 Management Joint Stock Company). In the previous period, the company reported a profit of 3.5 billion VND.

Doanh thu thuần quý 3/2023 của các doanh nghiệp logistics

Doanh thu thuần quý 3/2023 của các doanh nghiệp logistics

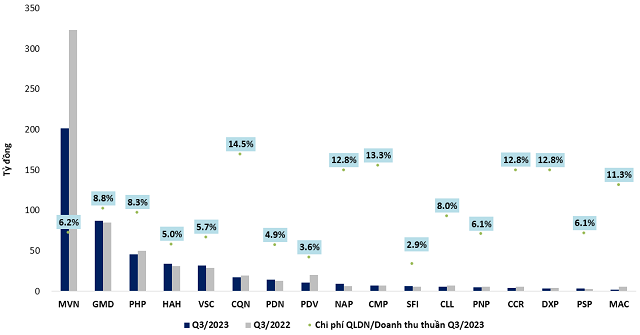

The logistics industry, in general, and port operation, in particular, incur minimal selling expenses, with most of the operating costs being business management expenses, mainly labor costs. Typically, state-owned enterprises have higher labor costs compared to private enterprises.

The ratio of business management expenses to gross revenue fluctuates between 3% and 14%, with most companies falling within the 6% range. The two companies with the highest ratios are CQN (Quang Ninh Port Joint Stock Company) at 14.5% and CMP (Chan May Port Joint Stock Company) at 13.3%. Following closely are NAP, CCR, and DXP with ratios of 12.8%. The companies with the lowest ratios include SFI, PDV, and PDN, which are below 5%.

Chi phí quản lý doanh nghiệp quý 3/2023 của các doanh nghiệp logistics

Chi phí quản lý doanh nghiệp quý 3/2023 của các doanh nghiệp logistics

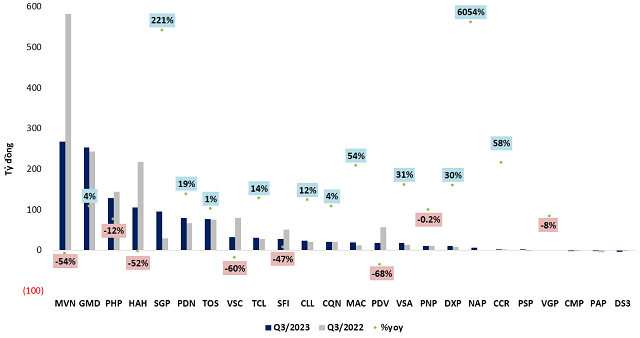

In terms of net profit, there is a clear differentiation among logistics companies. PDV, VSC, MVN, and HAH reported the most significant decreases in net profit, with reductions of 68%, 60%, 54%, and 52% respectively. On the other hand, some companies achieved higher net profits despite lower revenue, such as SGP, CCR, MAC, VSA, and CQN, with SGP notably posting a 221% increase.

SGP’s profits mainly stemmed from the recovery of bad debt provisions. As of the third quarter of 2023, SGP still had 116 billion VND in bad debt provisions, a 62% reduction from the beginning of the year. According to SGP’s assessment, the recoverable amount for the company is approximately 48 billion VND.

GMD saw a slight increase in profits due to improved gross profit margins, increased financial revenue, and reduced expenses, resulting in a 4% increase in net profit to 254 billion VND.

Lãi ròng quý 3/2023 của các doanh nghiệp logistics

Lãi ròng quý 3/2023 của các doanh nghiệp logistics

In summary, the logistics industry is currently undergoing a complex phase with significant differentiation among companies operating in the sector.

https://vietstock.vn/2023/11/loi-nhuan-trai-chieu-cua-doanh-nghiep-logistics-737-1122430.htm